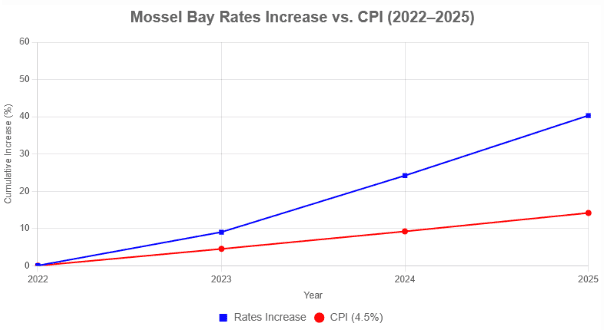

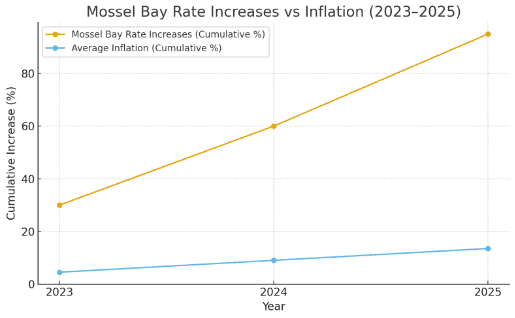

From 2023 to 2025, Mossel Bay ratepayers have faced a staggering 95% increase in rates and fixed charges — more than 20 times the average inflation rate of 4.5%.

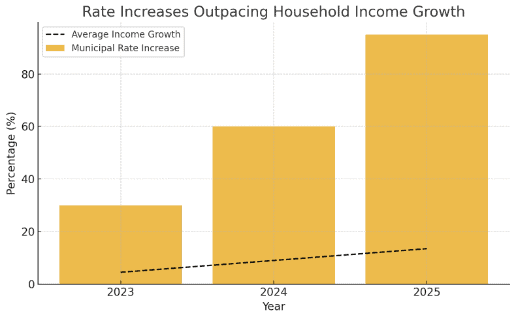

Households, pensioners, and local businesses are under strain as the cost of living rises far faster than incomes. The municipality’s decision to fund projects through extreme rate hikes rather than sustainable financing is creating long-term financial instability for residents and eroding trust in local governance.

Mossel Bay’s municipal leadership has chosen to cover new capital projects, infrastructure upgrades, and SDG commitments directly through residential ratepayer bills instead of leveraging external funding, private partnerships, or phased project planning.

Despite the municipality’s natural revenue growth from new developments and expanding suburbs, residents are being taxed beyond inflation while salaries, pensions, and small business revenues remain stagnant.

Cap annual municipal increases at the official inflation midpoint (4.5%).

Require public consultation and justification for any deviation from inflation-based limits.

Improve communication and engagement with ratepayers.

Stop taxing residents for long-term capital projects — fund these through sustainable financing.

Address poverty drivers and enforce proper policing of illegal building and migration issues.

Mossel Bay’s municipal leadership has chosen to cover new capital projects, infrastructure upgrades, and SDG commitments directly through residential ratepayer bills instead of leveraging external funding, private partnerships, or phased project planning.

Despite the municipality’s natural revenue growth from new developments and expanding suburbs, residents are being taxed beyond inflation while salaries, pensions, and small business revenues remain stagnant.

Relevant links to Articles, Updates and other Supporting Documentation relating to this Issue